“He Saved $92K in Taxes With One Move His Accountant Never Mentioned”

Meet the strategy many CPAs don’t tell you about. One CEO quietly erased $92K in taxes last year—and redirected that money into a retirement asset that could grow into $1M. Learn their exact steps in just 12 minutes.

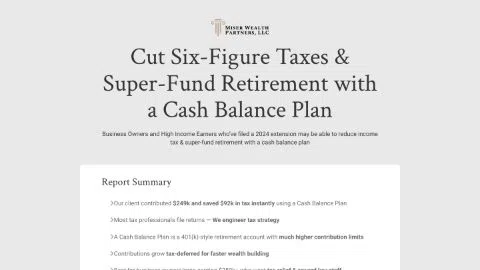

$249K

Contribution

$92K

Tax Saved Instantly

$1M

Growing Tax-Deferred

Report Summary…

How one high-income business owner wiped $92K from his tax bill

The overlooked strategy most CPAs never mention

Why high earners qualify for 4–6x higher contribution limits than a 401(k)

IRS-approved, completely legal, and already in use by top earners

Use it to build protected wealth and reward key staff

This years deadline is closing fast. You must act before your potential deductions are lost for good.

Get Instant Access

"I saved over $85,000 in taxes — and turned it into retirement wealth instead of giving it to the IRS." – Business Owner, 51

A Cash Balance Plan May put More Money In Your Pocket -

Don’t Let the IRS Keep Your Cash

ⓒ 2025 Miser Wealth Partners, LLC. All Rights Reserved | Privacy Policy-Pixel Policy-Terms of Use

Miser Wealth Partners, LLC offers financial products and services and is affiliated with Miser Asset Management, LLC, a registered investment adviser in the state of Tennessee providing asset management services. Miser Tax Advisory Services, LLC is a separate but affiliated entity offering tax planning and preparation services. All services are provided in accordance with applicable state and federal regulations.